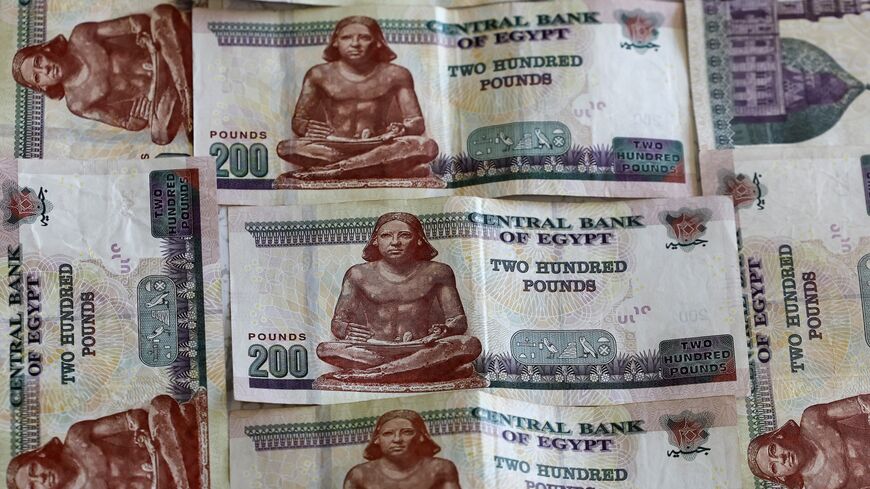

Egypt’s remittances reach $2.7 billion in boost to foreign reserves

Egypt’s liquidity crisis has been alleviated by recent investment from the United Arab Emirates and help from the International Monetary Fund, though inflation and debt remain issues.

Remittances from Egyptians abroad increased in May, reaching $2.7 billion in a boost for Egypt’s foreign currency reserves.

The Central Bank of Egypt said remittances increased in May for the third straight month. The figure for May constitutes a 26.6% increase from $2.2 billion in April and a 73.8% increase from $1.6 billion in May 2023, according to the bank.

The bank attributed the increase in remittances to Egypt’s economic reforms in March. At that time, the Central Bank instituted a massive 6% interest rate hike and further devalued the Egyptian pound to nearly 50 pounds to the US dollar. Higher interest rates can attract more remittances due to the greater appeal in depositing money in banks.

Why it matters: Egypt was dealing with a severe foreign currency shortage until recently. Decreased tourism during the COVID-19 pandemic, the supply chain shocks from the 2022 Russian invasion of Ukraine, and reduced trade through the Suez Canal as a result of Houthi attacks in the Red Sea have all led to decreased foreign cash entering Egypt.

The situation has prompted Egyptian banks to restrict foreign currency transactions in recent years. In January, some institutions reduced daily and monthly limits to as low as $50, Bloomberg reported at the time. Similar restrictions occurred in 2023 and 2022.

The level of reserves has improved recently. In March, the Egyptian government said it had received $10 billion from the United Arab Emirates’ pledge to invest $35 billion in Egypt. The same month, the International Monetary Fund increased its bailout loan to Egypt by $5 billion, while the European Union provided 1 billion euros ($1.08 billion) to the country in April as part of a loan deal.

Moving to a more flexible exchange rate was a condition set by the IMF.

Egypt’s foreign reserves hit what was then an all-time high of $46 billion in May, compared to $35.3 billion in February. Last month, net international reserves reached $46.38 billion, according to the Central Bank.

Know more: Egypt’s year-on-year inflation rate fell to 28.15% in May, marking the first time it was below 30% since January. Higher interest rates tend to lead to lower inflation.

Public debt has soared in Egypt under President Abdel Fattah al-Sisi, who came to power in 2014, and it remains an issue. Foreign debt hit $168 billion at the end of December, up from $164.5 billion in September, according to Reuters.

Bloomberg reported last month that Egypt seeks to push back the date on which some of its domestic debt is due.